[ad_1]

With a possible slowdown within the journey growth, ought to buyers take into account shopping for American Airways (AAL) after its current earnings launch? Let’s have a look at its monetary metrics to gauge its prospects….

Buyers are fearful that the post-pandemic journey growth may decelerate if the economic system reveals indicators of pressure, probably impacting the U.S. airline sector. With excessive inflationary pressures and ticket costs, airliners have mitigated price will increase. Nonetheless, falling ticket costs might put a cease to that hedge towards rising prices.

In opposition to this backdrop, American Airways Group Inc. (AAL) lately reported a year-over-year decline in its backside line for the third quarter ended September 30. The corporate additionally trimmed its revenue forecast from $3-$3.75 to the $2.25-$2.50 vary.

The corporate reported a $13.48 billion complete working income, lacking analysts’ anticipated determine of $13.52 billion. Nonetheless, AAL’s adjusted EPS of $0.38 topped the $0.25 analyst estimate.

this state of affairs, it appears crucial to take a look at the developments of AAL’s key monetary metrics to know why it might be clever to attend for a greater entry level within the inventory.

Monetary Oscillations for American Airways: A Overview from 2021 to 2023

The trailing-12-month web revenue of AAL exhibited a definitive upward pattern from December 31, 2020, to September 30, 2023.

- On December 31, 2020, the web revenue stood at unfavorable $8.89 billion, highlighting important losses.

- This pattern continued into the primary quarter of 2021, with a barely decreased lack of $7.89 billion in March.

- By the tip of the second quarter of 2021, on June 30, an enchancment was famous because the losses lessened to $5.81 billion.

- The third quarter of 2021 confirmed an extra discount in losses, with a unfavorable $3.24 billion in September.

- The web revenue improved noticeably by the tip of 2021, closing at a unfavorable $1.99 billion in December.

- Regardless of a small relapse to unfavorable $2.38 billion within the first quarter of 2022, the general enchancment noticed in 2021 was maintained all through 2022 and 2023.

- The corporate posted its first revenue on December 31, 2022, with a web revenue of $127 million.

- Subsequently, income elevated considerably all through 2023, peaking at $2.63 billion in June earlier than tempering barely to $1.61 billion in September.

The expansion price measured from the final worth to the primary displays a outstanding turnaround for AAL, from substantial losses in 2020 to returning to profitability by late 2022 and sustaining the constructive trajectory in 2023.

It must be taken under consideration that the emphasis is positioned enormously on the more moderen knowledge, notably the final reported determine in September 2023, which exhibited a constructive web revenue of $1.61 billion.

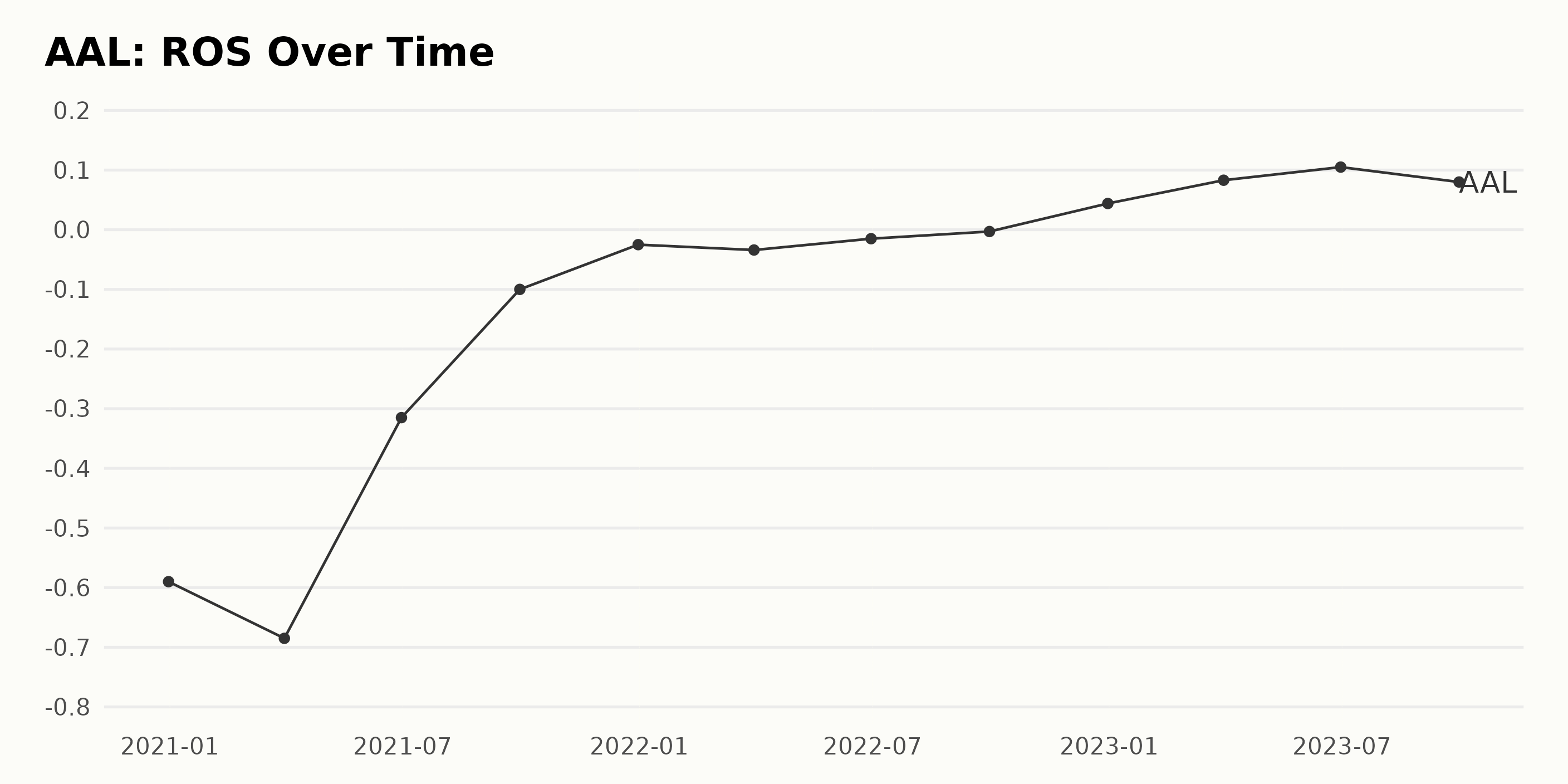

The information sequence represents AAL’s reported Return On Gross sales (ROS) between December 31, 2020, and September 30, 2023. Beneath are the highlights of the pattern and fluctuations:

- As of December 31, 2020, the AAL had a ROS of -0.59, indicating a unfavorable return.

- Over the primary three months of 2021 (ending March 31), the ROS additional dropped to -0.685. Nonetheless, since then, there was a transparent upward pattern within the agency’s efficiency, with the ROS persistently bettering over subsequent intervals.

- The corporate returned to constructive ROS figures by December 31, 2022, with an ROS worth of 0.044.

- Subsequently, the ROS continued to rise, peaking at 0.105 on June 30, 2023.

- As of the newest knowledge level, September 30, 2023, the ROS stands at 0.08.

In the end, from December 2020 to the tip of September 2023, the ROS went from -0.59 to 0.08, signifying a considerable enchancment in AAL’s working effectivity throughout this era.

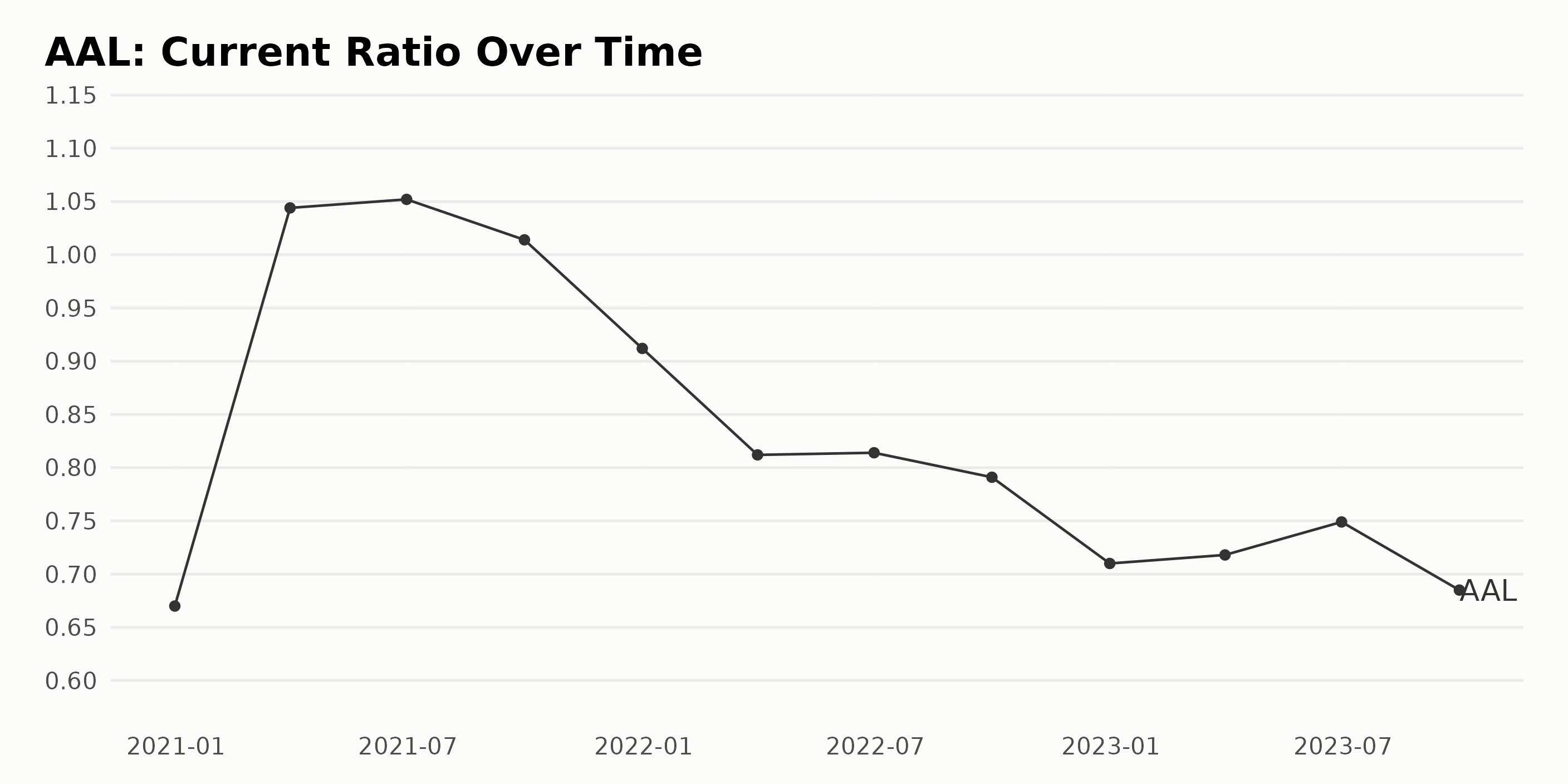

Beneath is a abstract of AAL’s present ratio developments and fluctuations primarily based on the offered knowledge sequence:

- On December 31, 2020, the present ratio for AAL was 0.67.

- The next quarters in 2021 confirmed an preliminary improve within the present ratio, reaching its peak worth of 1.052 on June 30, 2021.

- This upward pattern was short-lived because the ratio started to say no from September 2021, ending the yr at 0.912.

- The current developments and highlights (2022 to 2023) are as follows:

- The present ratio has usually proven a downward pattern from the start of 2022 to September 30, 2023.

- Regardless of minor fluctuations, comparable to a slight improve to 0.814 on June 30, 2022, and one other rise to 0.749 on June 30, 2023, the general motion is lowering.

- As of the ultimate reported interval on September 30, 2023, the present ratio stood at 0.685.

Development Fee: The expansion price, calculated by measuring the primary worth from the final worth, reveals a lower within the present ratio by roughly -0.02 or -2.99% over the whole thing of the noticed interval.

This evaluation emphasizes more moderen knowledge alongside the fluctuations and signifies a pattern of lowering liquidity as per the present ratio for AAL. Monitoring this pattern and its enterprise implications must be a precedence.

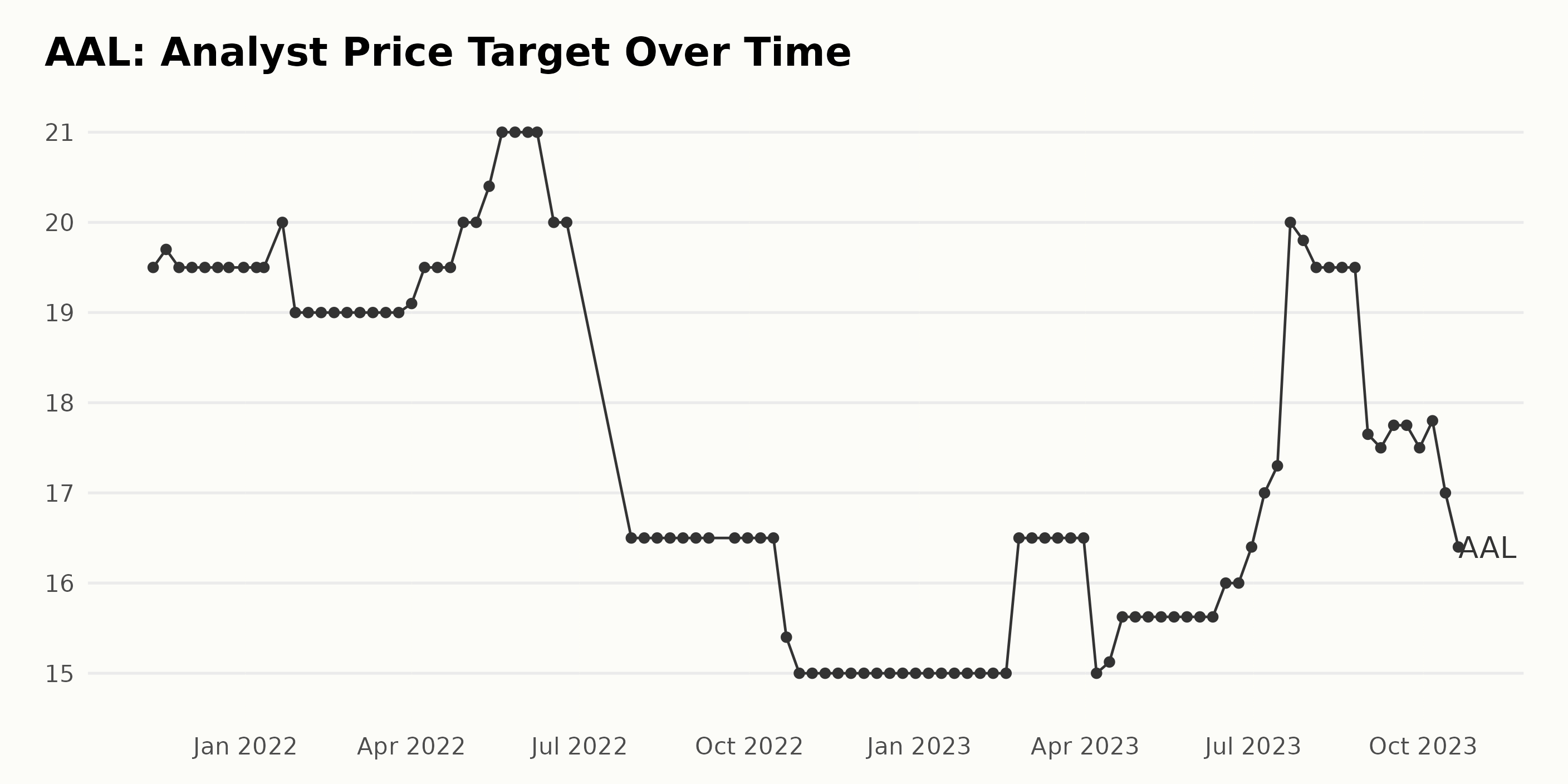

The analyst worth goal for AAL confirmed important fluctuations from November 2021 to October 2023. Listed below are key factors summarizing the pattern and variations:

- Ranging from a worth of $19.5 on November 12, 2021, the worth goal skilled minor fluctuations till reaching its native peak of $21 in Could 2022.

- This was adopted by a swift drop to $16.5 by July 2022, marking a discount of 21.43% from its earlier peak.

- The value goal remained regular at $16.5 for almost two months, then started a downward slope to achieve $15 by October 21, 2022.

- It maintained a continuing stage till February 24, 2023, when it elevated again to $16.5, creating an uptick of 10% compared to values held since October 2022.

- From April 2023 onward, the sequence takes an upward pattern earlier than experiencing one other important soar to $20 by July 2023.

- Nonetheless, the worth goal slid down shortly after, settling at round $17.8 in October 2023.

Wanting on the total pattern, the analyst worth goal decreased from an preliminary worth of $19.5 to a closing worth of $16.4, marking a complete lower of roughly 15.9%. Current knowledge holds extra weight, and the drop from $19.5 in August 2023 to $16.4 in October 2023 signifies a reasonably substantial lower of 15.9% in current months, representing a bearish sentiment amongst analysts for the long run efficiency of AAL.

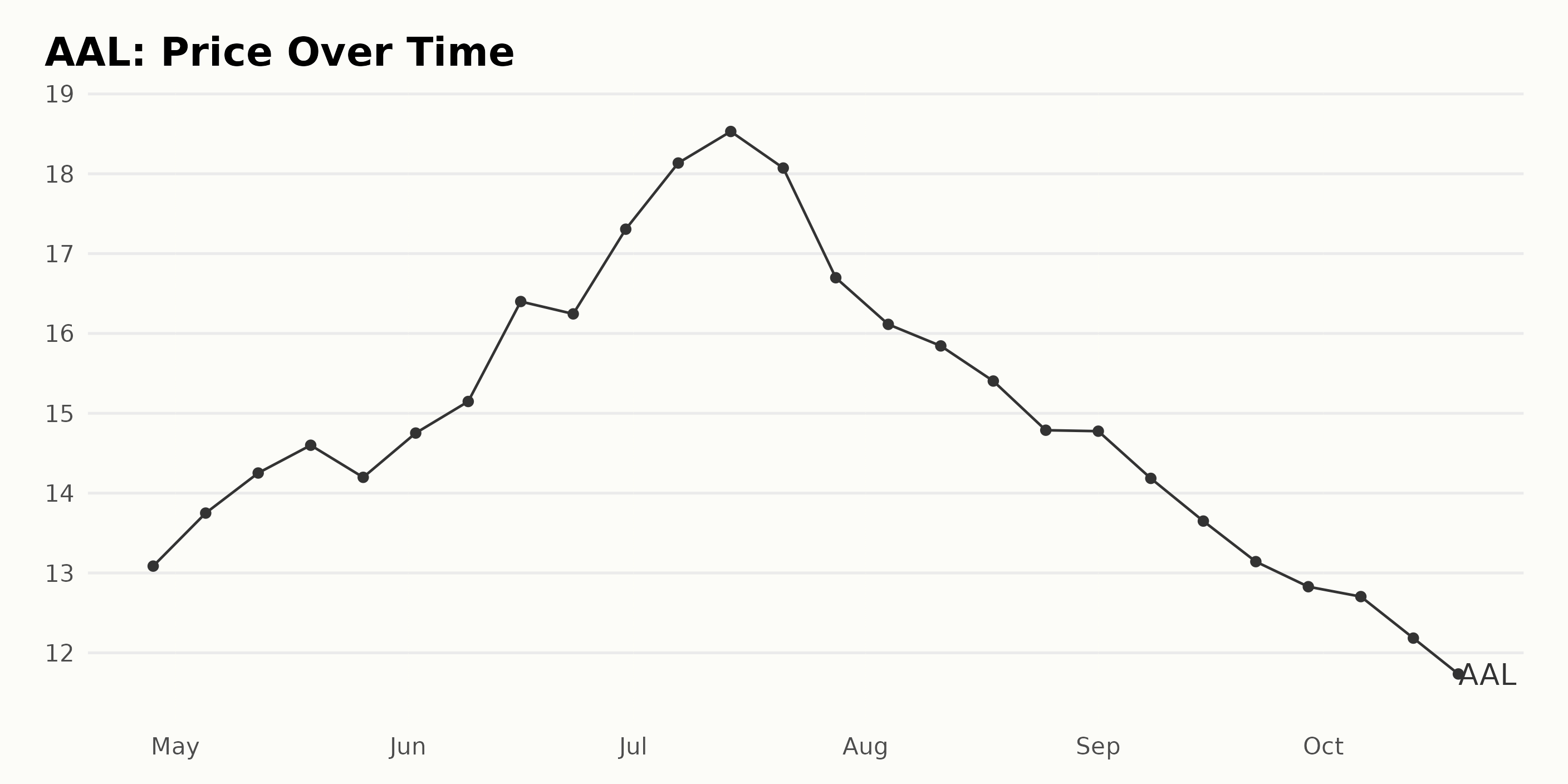

Six-Month Overview: American Airways Share Worth’s Rise and Fall in 2023

Analyzing the offered knowledge for AAL, plainly the share costs skilled some fluctuations however total adopted a transparent pattern from April to October 2023.

- In April 2023, the share worth began at $13.09.

- All through Could, the share worth grew steadily week by week, reaching a peak of $14.60 on Could 19, 2023, earlier than dropping barely to $14.20 by the month’s finish.

- The upward pattern continued in June, with the share worth progressively rising every week and in the end hitting its highest worth of $17.31 by the tip of the month.

- July noticed one other surge, peaking at $18.53 halfway by means of the month, adopted by a gradual decline to $16.70 by its finish.

- This decline continued into August; the share worth fell repeatedly all through this month, ending at a low of $14.79.

- September confirmed an analogous pattern, with the share worth falling additional to $12.83 by the tip of the month.

- By mid-October, the share worth had dropped once more, settling at $11.45 within the final buying and selling session.

General, it’s evident from the information that the shares of AAL went by means of a part of progress after which contraction throughout the six-month timeframe. Initially, the shares skilled a gentle acceleration adopted by a transparent deceleration pattern after July. Here’s a chart of AAL’s worth over the previous 180 days.

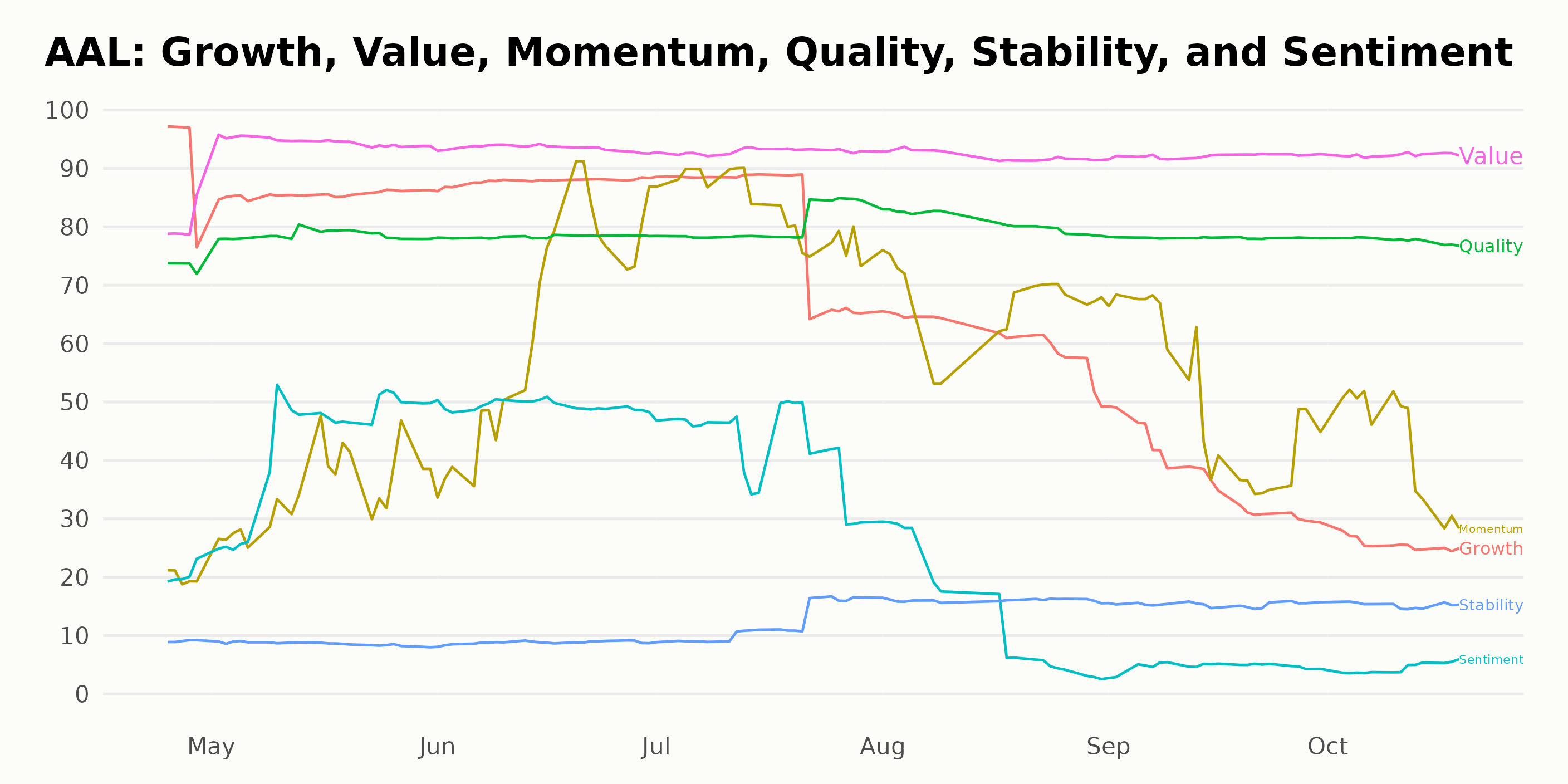

Analyzing American Airways’ POWR Scores: Development, High quality, and Worth in 2023

As of the newest knowledge on October 19, 2023, AAL, which is among the many 28 shares within the Airways class, has a POWR Scores grade of C (Impartial). This denotes a mean efficiency contemplating varied components analyzed by the POWR grading system. Beneath is a gradual transition of AAL’s POWR grade and rank within the class over the course of a number of months:

- On April 29, 2023, it held a POWR grade of C (Impartial) and was ranked #11 within the class.

- The corporate witnessed a gentle enchancment in Could with a grade B (Purchase) and ascended to a superior rank of #6 by Could 13, 2023.

- This B (Purchase) grade continued by means of June, July, and most of August regardless of slight variations in its rank, various between #8 and #10 largely.

- Nonetheless, in the direction of the tip of August 2023, its POWR grade fell to C (Impartial) and declined to #12 within the class on August 9, 2023.

- Within the following weeks, the rank dropped all the way down to #13 however did not see a lot fluctuation till the final recorded date on October 19, 2023.

- As of October 20, the POWR grade stands at C (Impartial), with a rank-in-category of #15.

Primarily based on the offered knowledge, the three most noteworthy POWR Scores dimensions for AAL are Development, High quality, and Worth, with Worth persistently scoring the very best throughout totally different dates. Let’s dive deeper into every considered one of these.

Development:

From April 2023 to October 2023, Development reveals a unfavorable pattern. Beginning at 93 in April 2023, this score regularly decreases, reaching its lowest level at 26 by October 19, 2023.

High quality:

Compared, High quality stays pretty constant over time. This dimension begins at 73 in April 2023 and peaks at 81 by August 2023. Regardless of slight fluctuations, High quality maintains excessive rankings all through the remainder of the yr, ending at 78 by October 2023.

Worth:

Lastly, Worth is the standout performer. It persistently scores highest among the many three dimensions all through the interval, beginning at 80 in April 2023, peaking at 95 by Could 2023, and remaining stable at 92 from July to October 2023. Thus, concerning the Worth dimension, AAL holds a robust place all through 2023.

It is clear that whereas Development reveals a lower, High quality stays comparatively steady, and Worth stays extremely rated throughout the examined interval. These developments present priceless perception into the efficiency of AAL.

How does American Airways Group Inc. (AAL) Stack Up In opposition to its Friends?

Different shares within the Airways sector which may be price contemplating are Cathay Pacific Airways Restricted (CPCAY), Air Canada (ACDVF), and Singapore Airways Restricted (SINGY) – they’ve higher POWR Scores. Click on right here to discover extra Airways shares.

What To Do Subsequent?

43 yr funding veteran, Steve Reitmeister, has simply launched his 2024 market outlook together with buying and selling plan and prime 11 picks for the yr forward.

2024 Inventory Market Outlook >

AAL shares fell $0.03 (-0.26%) in premarket buying and selling Friday. 12 months-to-date, AAL has declined -9.98%, versus a 12.74% rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Anushka Dutta

Anushka is an analyst whose curiosity in understanding the affect of broader financial modifications on monetary markets motivated her to pursue a profession in funding analysis.

The publish American Airways (AAL): Analyzing the Airliner’s Current Inventory Efficiency appeared first on StockNews.com

[ad_2]